Simple Interest Formula Explained

Understanding simple interest is crucial in the financial world, giving you insights into how much you earn or owe over a period. Let's break down the simple interest formula, making it easy to grasp and apply.

What Is Simple Interest?

Simple interest is a fundamental financial concept where the interest is calculated only on the principal amount, or the initial sum of money that was loaned or invested. Unlike compound interest, where interest is calculated on the principal and also on any accumulated interest, simple interest is straightforward and predictable, making it particularly suitable for short-term financial products or investments. This method is commonly applied to various financial instruments, such as certain types of loans, bonds, and savings accounts, providing a clear and easy-to-understand framework for calculating interest over time.

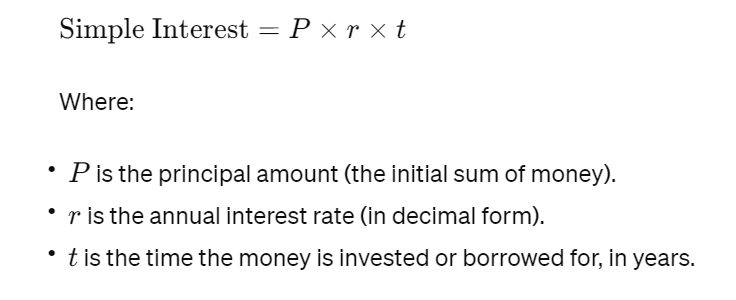

The Simple Interest Formula

The formula to calculate simple interest is:

Here are few examples of simple interest calculations which can quickly be preformed with a simple interest calculator:

Example 1: Saving Account Interest

You deposit $2,000 at a 3% annual rate for 4 years. You multiply $2,000 by 0.03 and then by 4. The interest earned is $240.

Example 2: Loan Interest

For a loan of $5,000 at a 6% annual rate for 1 year, multiply $5,000 by 0.06 and then by 1. The interest paid on the loan is $300.

Example 3: Investment Growth

With an investment of $3,000 at an annual rate of 4% for 3 years, you multiply $3,000 by 0.04 and then by 3. The interest from the investment is $360.

If you need to quickly calculate simple interest check out our simple interest calculator.

For more math, statistics and finance resources and materials visit z-table.com.

If you need to quickly calculate simple interest check out our simple interest calculator.

For more math, statistics and finance resources and materials visit z-table.com.